By Dale S. Lam, CPA / PFS, CFP®

January, 2014, Excerpt from Quarterly Client Commentary

There is a commercial on TV that strikes me as both comical and serious. It’s difficult to explain, but here goes:

The scene is an upscale art auction where there are many prospective buyers bidding on a painting. At the end of the bidding process, the auctioneer recognizes an intelligent looking middle aged gentleman as the winner. The gentleman promptly stands up and says, “I’d like to sell it now”.

The auctioneer looks perplexed, and the commercial fades into a promotion for one of the discount retail brokerage firms.

We all know that it is ludicrous to think that we could be the highest bidder at an auction and then immediately sell the same item to fellow bidders for a higher price. Unfortunately, this mentality often permeates our investment culture today, especially for inexperienced investors. The hope is “to get rich quick”. In reality, getting rich quickly only happens in extreme situations – namely, winning the lottery.

We typically focus far too much on short term results – how well we did today, last month or last year. In contrast, patient, successful investors remember that when investing in marketable securities, we are generally investing in the long term performance of a business or some other investment structure.

Most of us either own our homes or have owned our homes previously. Others have been involved with a business, either as an employee or an owner. How much value was gained in your home the first year you owned it? How much did your business go up in value in a few months or even a few years? Those investments are similar to the investments that we have made for your portfolio – they have generally done fairly well over long periods of time, but they certainly have their ups and downs along the way

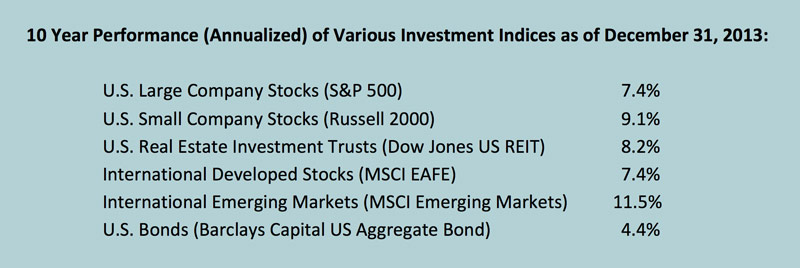

So before we get too excited about last year’s performance in the stock markets, let me shift our focus to long term performance, which I deem as 10 years (or more):

The above returns cover the period from Jan. 1, 2004 through Dec. 31, 2013. There were good years and bad years. In fact, in case we have short-term memories, there was one very bad year – 2008. In 2008, the losses for the stock categories were in the 40% range. They varied from a loss of 33.8% to a loss of 53.2% – all were terrible (unless you were invested in bonds only). But even after fully absorbing the 2008 declines, the 10 year returns for the patient investor are results that I think most of us would be pleased with. (Coincidentally, guess which asset class was down 53.2% in 2008? Yep – the one with the highest 10 year return of 11.5% annually – the emerging markets investments. They are riskier, but have provided higher long term returns, proving once again that risk and return are related).

The stock market, like the painting from the art auction, isn’t something that we can buy today and expect to sell quickly for a profit. Fortunately, long term trends such as population growth, increasing worldwide middleclass status, and advancing technologies and products, provide the environment for achieving prudent long term investment returns despite the short term volatility in market pricing. We all enjoy the end results of our long term strategies – it’s just the short term fluctuation that makes us uneasy.

Past performance is not a guarantee of future results. Any indices referenced are unmanaged and cannot be invested in directly. See Disclosures.