By Dale S. Lam, CPA / PFS, CFP®

Summer, 2019, Excerpt from Strategent Financial Wealth Management Outlook 2019

From a recent survey performed by the Nationwide Retirement Institute, future retirees are increasingly looking to their financial advisor for guidance on maximizing retirement income by minimizing their taxes.

More than 80% of future and recent retirees said they expect their financial advisor to help them plan for taxes during retirement. Nearly 40% said they would consider switching advisors to get one that would help them with planning for taxes in retirement.

“Smart strategies for sequencing withdrawals can extend a client’s income in retirement up to an additional six years,” according to Eric Henderson, president of Nationwide Life Insurance, commenting on research published in 2015 by the CFA Institute Financial Analysts Journal.

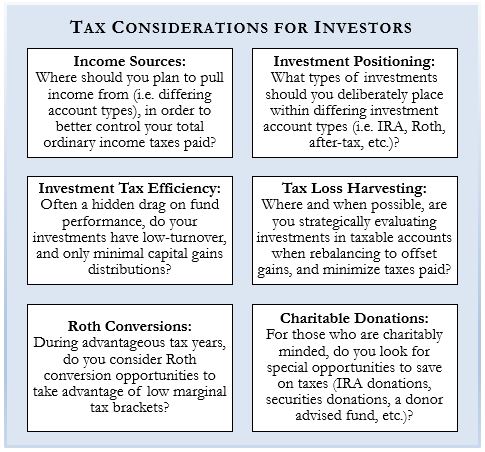

Tax efficient strategies don’t happen by accident – they require a deliberate and coordinated strategy, specific to one’s unique situation. Planning for and reviewing tax implications is a core part of Strategent’s service. Additionally, we communicate and coordinate plans with outside tax advisory firms utilized by our clients to streamline the work and ensure a cohesive approach to achieving tax efficiencies.

Past performance is not a guarantee of future results. Any indices referenced are unmanaged and cannot be invested in directly. See Disclosures.