By Dale S. Lam, CPA / PFS, CFP®

October, 2022, Excerpt from Quarterly Client Commentary

2022 has certainly seen its share of challenges, especially on the investment front. The most dominant themes seem to center around rising interest rates, inflation, and the Russia / Ukraine conflict. Unfortunately, trying to predict what Russia, under the guidance of Vladimir Putin, may or may not do on any given day is a wild card. As for rising interest rates and inflation, while the topics are somewhat related, they are also vastly different. For the purposes of this commentary, we’ll try to put some perspective on interest rates, leaving the inflation topic for another day.

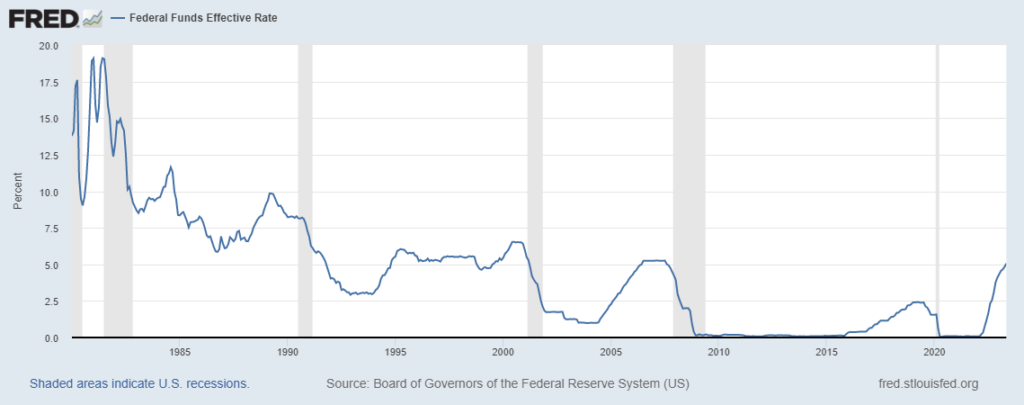

Interest rates have increased this year, as expected. But the real shock to the markets (and markets do not like shocks or surprises) has been the rate of increase. Last year, in September of 2021, the Federal Reserve through its Federal Open Market Committee (FOMC) report projected interest rates they control (called the federal funds rate) would be approximately 0.1% to 0.35% higher in 2022. Fast forward to September of this year, and the actual increase incurred has been 3.0%. The Fed drastically missed the mark – by give or take 10 fold. And, they now indicate further increases of about 0.9% to 1.6% in the coming year. The rapid increases were done primarily to combat inflation, but nonetheless, the increases were a shock to market participants.

What’s the implication for our portfolios, specifically the stock market? Our goal over time is to own successful businesses that produce solid cash flows and profits, hopefully growing over time. We never get that fully correct – we always end up with some laggards or even losers in the investment mix, but the best businesses have overshadowed the negatives and produced solid returns for patient investors. That’s been the case historically and we think that remains the case in the future. Can businesses survive, and even thrive, in the higher interest rate environment that we are currently facing? We feel the answer is unequivocally YES.

Instead of focusing on what the federal reserve is going to do with rates next month or next quarter, some historical context is quite beneficial.

Looking at a 30-year period that includes the 1980’s, 1990’s and the 2000’s, we see that the average Wall Street Journal prime interest rates during those decades approximated 6% (in the 2000’s) to almost 12% (in the 1980’s), with ~ 8.6% as the average rate over the entire time period. Note that the prime interest rate is generally about 3% over the federal funds interest rate and is often used as a metric for the rate that banks charge their corporate clients. We are using that 30-year time period as a long period of time when rates were primarily “reasonable”. Yes, there were some very high rates in the early 1980’s and some pretty low rates at the end of the 2000’s, but overall, we think this captures a reasonably indicative range for interest rates.

How did businesses, and more specifically stock market returns, look during that 30-year period? Using the S&P 500 as a guideline, on January 1, 1980 the S&P 500 was 107.9. On December 31, 2009 the S&P 500 was 1,115. The annualized return of the S&P 500 for that total time period was 11.2%. And, as a reminder, that 30-year period included the Dot-Com bubble bust in 2000, the 9-11 attacks in 2001 and the Global Financial Crisis of 2008, so it was not all roses during that time period. Remember, the average prime interest rate during that time period was ~ 8.6%.

Where are rates now and where might they go in the next year or so?

- The current Wall Street Journal Prime Rate is 6.25% (with the current federal funds rate at 3.0% to 3.25%).

- Where might rates go in the next year or so? Candidly, most anything could happen going forward, but if we use the most recent estimates by the FOMC, rates could rise another ~ 1% to 1.6%.

By now, you’re probably quite bored by interest rates and historical statistics, but the major take away is that historically businesses have done quite well, even when interest rates are higher than they are today and are expected to be in the not too distant future.

Past performance is not a guarantee of future results. Any indices referenced are unmanaged and cannot be invested in directly. See Disclosures.