By Dale S. Lam, CPA / PFS, CFP®

Summer, 2020, Excerpt from Strategent Financial Wealth Management Outlook 2020

According to most recent data from Giving USA, charitable giving declined by 1.7% in 2018 after the new tax law went into effect, when adjusted for inflation. Individual giving (the single largest source of overall charitable contributions) fell the most, by 3.8% on an inflation-adjusted basis, to $292.1 billion.

Aside from the 2008 Financial Crisis, a reduction of that size had not been seen since 1987. Why the sudden decline, particularly when coinciding with a generally strong economy? Many experts point to changes in the 2017 tax law, which effectively eliminated certain tax incentives for individuals through deductions on their tax returns.

The new tax law doubled the standard deduction. For 2020, that number is now $12,400 for individuals, and $24,800 for married couples. According to estimates from the Tax Foundation, just 14% of taxpayers are projected to itemize deductions currently, compared with 31% before the tax reform took effect.

With this higher hurdle (standard deduction) for taxpayers to get over before seeing tax benefits from charitable gifts, many taxpayers may have instead opted to simply cut back on giving as a result.

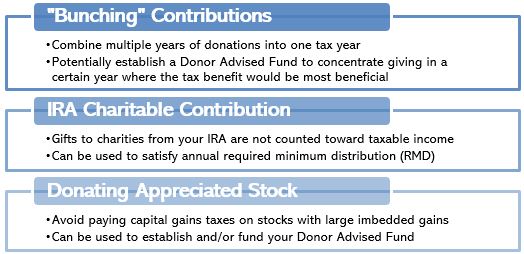

Giving by foundations saw a record-breaking year though, with giving up by an estimated 4.7%, adjusted for inflation. Some of this increase may have oddly come from tax savvy individuals, potentially shifting giving through other avenues – namely, “bunching” of several years of gifts by establishing a Donor Advised Fund.

Tax law changes alone may not be the sole factor affecting the data. In 2018, the stock market dropped sharply at the end of the year, perhaps deterring year-end giving that year. And now this year, with COVID impacting everything from employment, to the stock market, to required minimum distributions (RMDs), shifts in giving at this point appear to be somewhat of a foregone conclusion, even less than halfway through 2020.

For charitably minded and tax conscious individuals, giving to causes which they care about has not stopped or necessarily been reduced.

Many have instead shifted how they give to organizations that they care about. Outlined in the chart to the left are some of the common alternative methods being utilized for donations today.

Past performance is not a guarantee of future results. Any indices referenced are unmanaged and cannot be invested in directly. See Disclosures.